|

|

#1 |

|

Участник

|

Sumit Potbhare: ePOS | AX 2012 R3 | Expense account transaction

Источник: https://sumitnarayanpotbhare.wordpre...t-transaction/

============== Hi Guys, In this blog we are going to see the Expense account functionality at POS and how it post to Trial balance. Expense account transactions are done when we remove the Cash from Cash drawer for occasional purpose like paying for Daily newspaper, magazines etc. Setup Expense accounts To start with, we need to setup expense accounts on store card. There is no centralized setup for defining expense account because each store might want to reflect the postings in separate account.

Field Description Account number Enter a unique identifier for the income account or expense account, such as “sales,” “COGS,” or “returns.” Name Enter a name for the income account or expense account. Search name A simple name that can help you find the income account or expense account when you search. Account type Select Income or Expense to specify the type of account that you are setting up. Ledger account Select the number of the general ledger account for the income account or expense account. Name The name of the ledger account that you selected. Setup Expense account operation button on screen layout

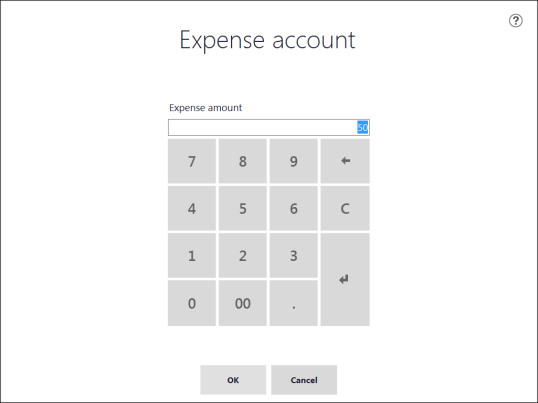

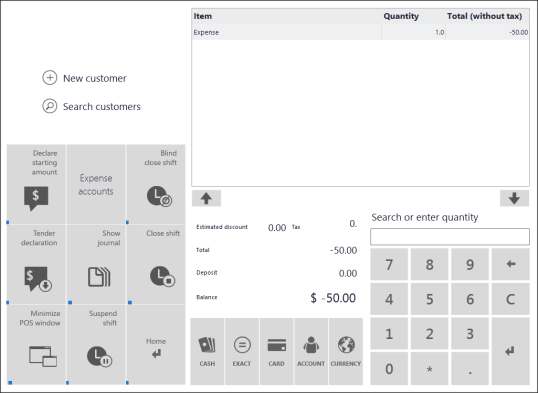

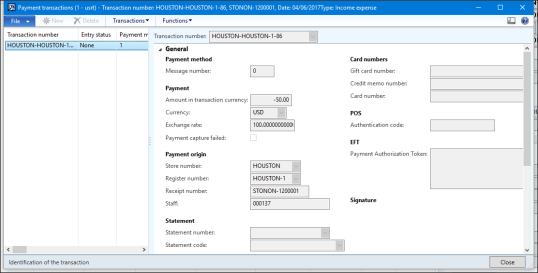

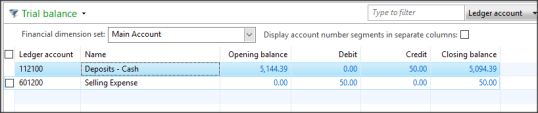

Click on Expense account button.  Select from different Expense type setup on the store.  Enter the amount for the Expense.  Now complete the transaction using the payment method that you paid the expense.  Run the P-job to pull the transaction to DAX. Statement posting & Trial Balance  Retail Store transactions inquiry Retail Store transactions inquiry Expense transaction Expense transaction Payment transaction Payment transactionNow lets proceed for Statement posting.  So we have account number 112100 defined on the Cash account for the store Cash payment method and 601200 defined as Expense account.  After Statement posting –    This is it from this blog. Income transaction is similar to expense which I will cover in separate blog. Feel free to reach out for any clarifications. If you like my blog posts then comment and subscribe to the blogs. Please follow me on Facebook | Google+ | Twitter | Skype (sumit0417) Enjoy RetailDAXing. Disclaimer: The information in the weblog is provided “AS IS”; with no warranties, and confers no rights. All blog entries and editorial comments are the opinions of the author. Источник: https://sumitnarayanpotbhare.wordpre...t-transaction/

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

| Опции темы | Поиск в этой теме |

| Опции просмотра | |

|