|

|

#1 |

|

Участник

|

dynamicsax-fico: A note on vendor cash discount posting options

Источник: https://dynamicsax-fico.com/2016/05/...sting-options/

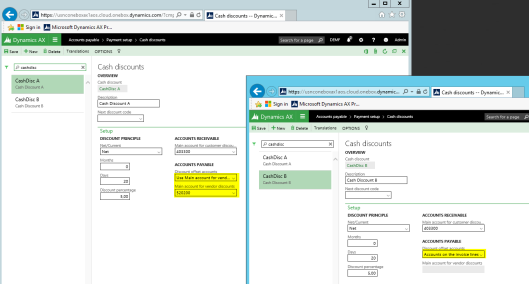

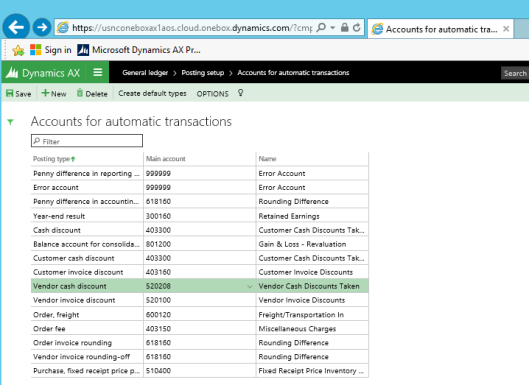

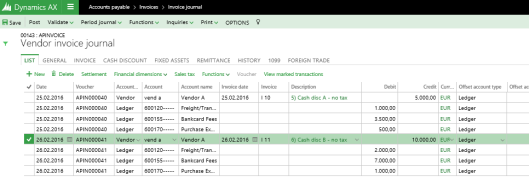

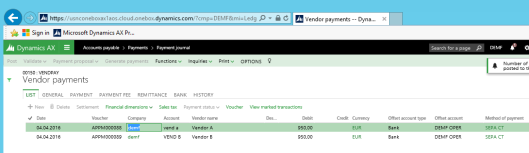

============== This post deals with the question how Dynamics AX decides which cash discount account to use when posting vendor cash discounts that get deducted when paying vendor invoices. Answering this question might seem straightforward especially for those of you who already worked with Dynamics AX for some time. Yet, recently – with AX2012 R3 – a new feature was added to the Dynamics AX cash discount form that offers new possibilities for recording cash discounts. The feature I am referring to is a Dynamics AX public sector functionality that can generally be made available also for companies not operating in the public sector by activating the respective configuration key in the system administration module. If this configuration key is enabled you will find the following new parameter in the cash discount form that allows you specifying whether the cash discount account shall be taken from the cash discount form (as before) or from those accounts that are used when recording the invoice.  A. Overview With this additional possibility in place I created the following graph that illustrates how Dynamics AX determines the ledger account taken for posting cash discounts.  What this graph tells you is that Dynamics AX uses the main accounts that were used when posting the original vendor invoice for posting the cash discount if the new parameter is set to “accounts on the invoice lines”. If the new parameter is set to “main account for vendor discounts”, AX uses the ledger account from the cash discount form for posting the cash discount given that the original vendor invoice has been posted without sales tax. If the original vendor invoice is posted with sales tax and if a vendor cash discount account is setup in the sales tax ledger posting form, Dynamics AX uses this account instead of the one from the cash discount form. In other words, the cash discount account setup in the sales tax ledger posting form overwrites the one setup in the cash discount form if the original invoice includes sales tax. B. Setup In order to show you the difference in activating the new parameter, two cash discount codes have been setup; one with the standard AX functionality that has already been available in prior Dynamcis AX versions (“cash discount A”) and one with the newly available parameter set to invoice lines (“cash discount B”). Please see the next screen-print for details.  As cash discount accounts can also be taken from the automatic posting accounts setup in GL, a separate vendor cash discount account (no. 520208) has been setup in this form to clearly identify situations where the vendor cash discount account is taken from the automatic accounts setup in GL.  What has been said for the automatic posting accounts in GL also holds for the vendor cash discount account setup in the sales tax ledger posting form. That is, in order to identify situations where the cash discount account is taken from this form, a separate ledger account (no. 520209) has been setup as illustrated in the next screen-print.  C. Demo transactions Now let’s have a look at some sample transactions in Dynamics AX. With the setup illustrated in the previous chapter in place, the following four vendor invoices have been recorded in an ordinary vendor invoice journal in Accounts Payable.  The major differences in the four invoices recorded can be identified by the descriptive text that is added to each invoice line. That is,

D. Split postings Now let’s have a look at some split postings and how the new cash discount parameter deals with those transactions. To identify what AX is doing in case of split postings, the following two invoices have been recorded:

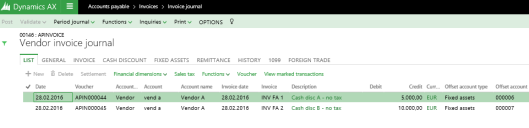

E. Other account transaction types In this final sub-chapter I want to take a look at those invoice transactions respectively payments that do not use a ledger account as offset account. E.1. Fixed asset transactions The first transactions I want to take a closer look at are fixed asset transactions. Fixed asset transactions are “special” when it comes to cash discount postings as a separate fixed asset parameter exists that defines whether cash discounts shall be deducted from the fixed asset value or not. (Please see the next screenshot).  In order to identify the effect that the new cash discount parameter has on fixed asset cash discount postings, the subsequent transactions are first recorded with the fixed asset parameter activated and thereafter without having it activated. E.1.1. Fixed asset transactions – fixed asset parameter “deduct cash discount” activated To identify what difference the new cash discount parameter makes to fixed asset postings, two fixed asset invoices have been recorded; the first one with the ordinary cash discount code “A” and the second one with the newly available cash discount feature “B”. (Sales taxes are ignored for reasons of simplicity).  After paying the respective vendor invoices, the following vouchers result:

E.1.2. Fixed asset transactions – fixed asset parameter “deduct cash discount” not activated Let’s now have a look at some similar fixed asset transactions with the fixed asset parameter “deduct cash discount” deactivated. To realize that, some similar invoices for two fixed assets have been recorded and been paid thereafter.  Outcome:

E.2. Purchase order invoices The last transactions I want to take a look at are cash discounts related to purchase order invoices. To compare what difference the new parameter makes to the cash discount postings for those kind of transactions I setup two vendors with the old (“cash disc A”) and the new (“cash disc B”) cash discount functionality. Example:  Thereafter, two identical purchase orders have been setup, invoiced and paid in order to compare the vouchers generated.   Outcome:

Summary To sum up, using the newly available cash discount functionality that allows recording vendor cash discounts on the ledger accounts that have been used when recording the original vendor invoice can be interesting for expense transactions that use a ledger account as offset account. That is because the new functionality allows you identifying the net effect of those transactions without having to add up amounts posted in different ledger accounts. Yet, as soon as it comes to fixed asset or inventory related transactions, things can go terribly wrong; meaning that the new cash discount parameter can result in differences between GL and sub-ledger balances. Filed under: Accounts Payable Tagged: Accounts on the invoice lines, Cash discounts, Offset account Источник: https://dynamicsax-fico.com/2016/05/...sting-options/

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

| Опции темы | Поиск в этой теме |

| Опции просмотра | |

|