|

|

#1 |

|

Участник

|

dynamicsax-fico: Parallel accounting according to the “Cost of Sales” and “Nature of Expense” accounting method (5)

Источник: https://dynamicsax-fico.com/2016/07/...ting-method-5/

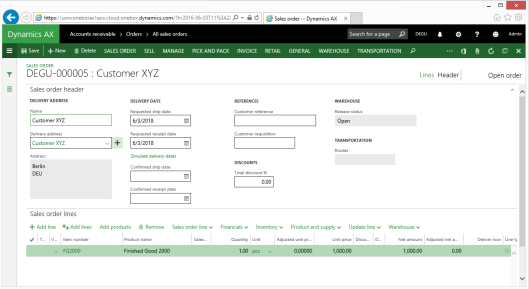

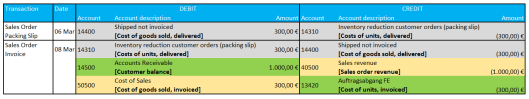

============== C.6. Sale of goods Within the last part of this series on the COS & NOE accounting method, the item that has been produced before will be sold for 1000 EUR / pcs through a standard customer sales order shown in the next screen-print.  The first sales order related voucher is created when the sales order packing slip is posted. In the example used, Dynamics AX created the following voucher:  As only Balance Sheet accounts are addressed, no influence on the company’s Income Statements can be identified and as a result, no difference between the COS and NOE method arises. The next and final posting step in my example is related to the sales order invoice. The voucher created when posting the invoice is shown in the next screen-print.  For reasons of clarity and traceability, the vouchers created when posting the sales order packing slip and sales order invoice, have been summarized in the next illustration.

D. Summary Within this series on the COS and NOE accounting method I demonstrated that Dynamics AX can be setup in a way to generate financial statements that follow both accounting methods in parallel. This also holds for situations where other inventory valuation principles, such as standard costs, moving average costs, etc. are used. Irrespective of those valuation principles and differences thereof, the key to a successful parallel implementation of both principles is a “correct” setup of your chart of accounts and related account structures. Filed under: Accounts Payable, Accounts Receivable, Fixed Assets, General Ledger, Inventory Tagged: Cost of Sales Method, Nature of Expense Method, Posting setup, Profit & Loss Statement Источник: https://dynamicsax-fico.com/2016/07/...ting-method-5/

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

|